Tax Policy Must Be Led by Economists, Not Health Lobbies: FTT Chairman Ameen Virk

Virk Warns Against High Tobacco Taxes Citing Global Black Market Surge

ISLAMABAD — Chairman of Fair Trade in Tobacco (FTT), Ameen Virk, has urged the Government of Pakistan to ensure that economic experts, not health advocacy groups, lead the formulation of the country’s taxation policies. Speaking to senior journalists in Islamabad, Virk praised the Federal Board of Revenue (FBR) and federal authorities for their recent enforcement efforts against illegal tobacco trade and widespread tax evasion, calling them “essential and long overdue.”

“Pakistan loses nearly Rs. 400 billion annually due to illicit cigarette manufacturing and unchecked tax evasion,” said Virk. “This is not a minor issue—such a loss is unsustainable for a country already under immense fiscal pressure.”

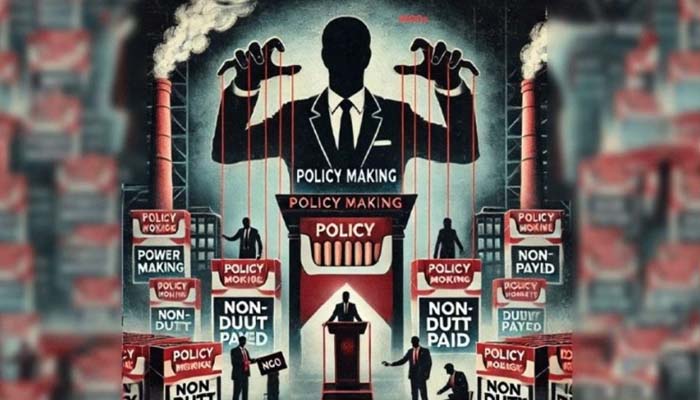

Virk criticized the recurring pattern of health advocacy groups resurfacing only during the federal budget season to campaign for tax hikes on legal tobacco products. “These groups, many of which receive foreign funding, stay silent for most of the year and then suddenly intensify lobbying efforts just before the budget. It raises serious questions about their objectivity and their alignment with national economic interests,” he stated.

He argued that taxation policy is a sovereign matter and should remain under the purview of trained economists and national institutions such as the FBR—not non-governmental or international organizations.

“Public health is important, but it should not be used as a cover for misguided tax policies that damage legitimate businesses while empowering illegal operators,” he asserted.

Read more: Tobacco farmers admitted that the advance income tax Rs 390/kg not applicable on growers,

Citing international examples, Virk warned that aggressive tax hikes on legal tobacco products in countries like Australia, the UK, and the US have led to the emergence of vast black markets worth billions of dollars. “Pakistan cannot afford to repeat these mistakes. We need balanced, economically sound taxation that doesn’t push legal operators out of business.”

He reaffirmed the Fair Trade in Tobacco’s full support for efforts to formalize the economy and curb illegal trade. “The path to sustainable revenue lies in strengthening legal markets and punishing illicit actors, not in burdening those already contributing to the national exchequer,” Virk concluded.

Comments are closed, but trackbacks and pingbacks are open.