Sales tax fraud: PM orders inquiry, identification of those involved

He was informed that the FBR reforms were presented as a case study at the global forum, which received international recognition.

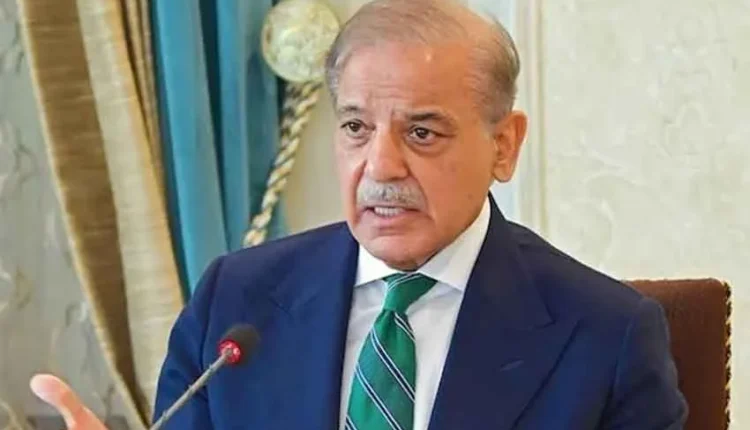

ISLAMABAD: Prime Minister Shehbaz Sharif has directed an inquiry to identify institutions, companies and individuals involved in sales tax fraud.

According to details surfaced on Thursday, chairing a review meeting on reforms in the Federal Board of Revenue (FBR), the prime minister was briefed on the participation of the FBR delegation in the annual World Bank Conference held in Washington.

He was informed that the FBR reforms were presented as a case study at the global forum, which received international recognition.

The prime minister commended the FBR team for the acknowledgment of their reforms and was briefed on the ongoing improvement initiatives, particularly within the Pakistan Revenue Automation Limited (PRAL).

Expressing concern over past incidents of sales tax fraud, the Prime Minister directed that a forensic audit of the PRAL system be conducted through an international consultancy firm. He instructed that all institutions, companies and individuals involved in the fraudulent activities be identified through a comprehensive investigation.

Read More: Non-Filers spending on Credit Cards could face legal action: FBR

The prime minister further ordered that the inquiry committee submit its report within three weeks. He emphasised strict legal action against all those found responsible in the report.

A fact-finding report concerning sales tax fraud committed during 2018–19 was presented to the Prime Minister. It was recalled that PM Shehbaz had taken notice of the issue in 2018 and had formed a fact-finding committee at that time.

According to the briefing, the sales tax fraud occurred due to the absence of effective monitoring and the lack of security in the PRAL database system.

Comments are closed, but trackbacks and pingbacks are open.