Pakistan Focuses on Structural Reforms for Long-Term Stability

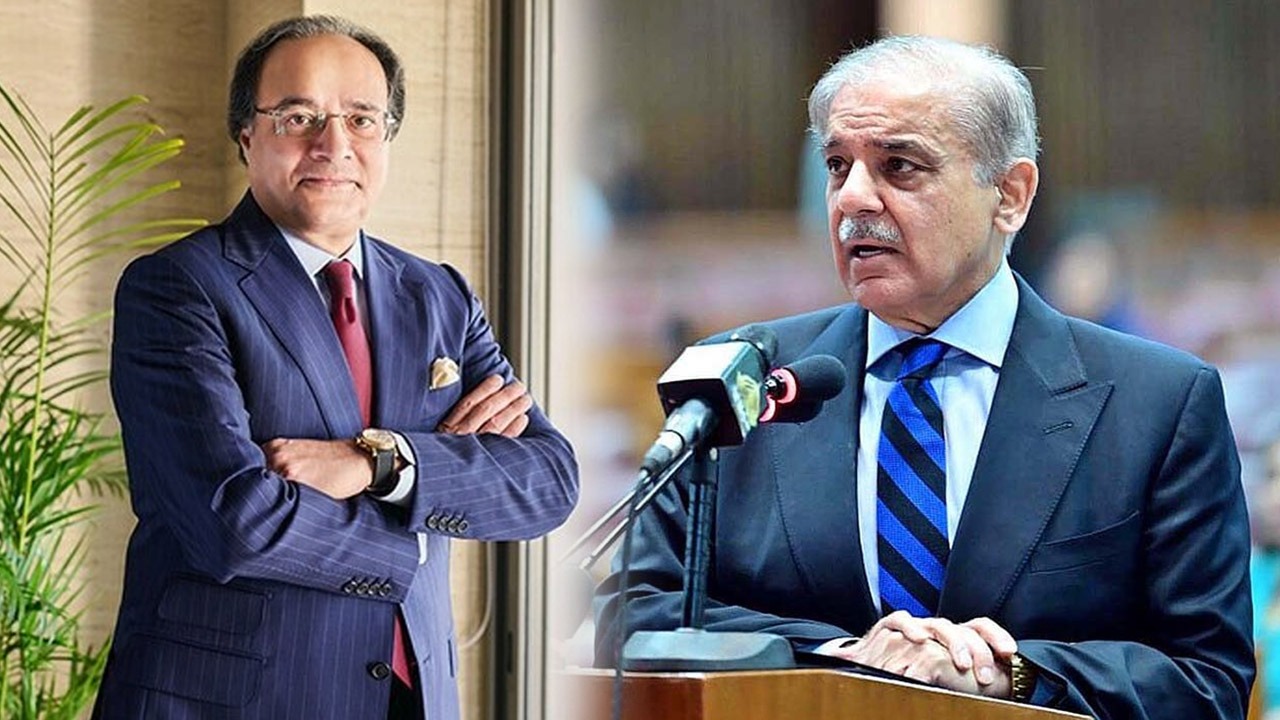

PM Shehbaz hopes it to be Pakistan’s last IMF borrowing.

Islamabad(Mudassar Iqbal)-Prime Minister Shehbaz Sharif has expressed his hope that the current $7 billion loan program from the International Monetary Fund (IMF) will be Pakistan’s last. The government is working to implement the IMF’s conditions to complete the 37-month loan program, which was agreed upon in July.

The IMF has stated that the program is subject to approval from its executive board and obtaining necessary financing assurances from Pakistan’s development and bilateral partners. Once the IMF board approves the program, Pakistan will enter a new phase, according to the premier.

Moody’s, which upgraded Pakistan’s rating to Caa2 last week, expects IMF board approval for the loan program within weeks. However, Pakistan’s loan approval is not included in the IMF Executive Board’s latest meeting agenda, raising concerns as this loan deal is crucial for stabilizing the country’s struggling economy.

On the other hand, the government is optimistic that the country will secure approval for the $7 billion bailout package from the IMF next month. Federal Minister for Finance and Revenue, Senator Muhammad Aurangzeb, stated that Pakistan had already signed a Staff Level Agreement (SLA) with the IMF and was in the advanced stages of securing the agreement’s approval by the IMF executive board.

Aurangzeb warned that securing the last IMF program would depend on structural reforms and the country becoming self-sufficient. He reaffirmed the government’s resolve to carry forward the reforms agenda, aiming at broadening the tax base and rightsizing the federal government to achieve macroeconomic stability.

The finance minister also vowed to persevere with plans for new taxes on the retail sector despite strike threats, as a step towards winning approval from the IMF board for the loan. The taxes, introduced in the June budget, faced public backlash and led to a nationwide strike by retailers last week.

IMF Executive Board Excludes Pakistan From Latest Meeting Schedule

The Fund’s board approval hinges on confirmation of financing assurances for Pakistan from development and bilateral partners. Local media reported the approval was delayed by a lack of additional financing and unpaid energy sector subsidies announced by the eastern province of Punjab and the federal government.

Reining in unresolved debt across Pakistan’s power sector is a top concern of the IMF. The Fund ended a $3-billion bailout in April, leading to higher tariffs, hurting the poor and middle class, and cutting household use for the first time in 16 years.

Comments are closed, but trackbacks and pingbacks are open.